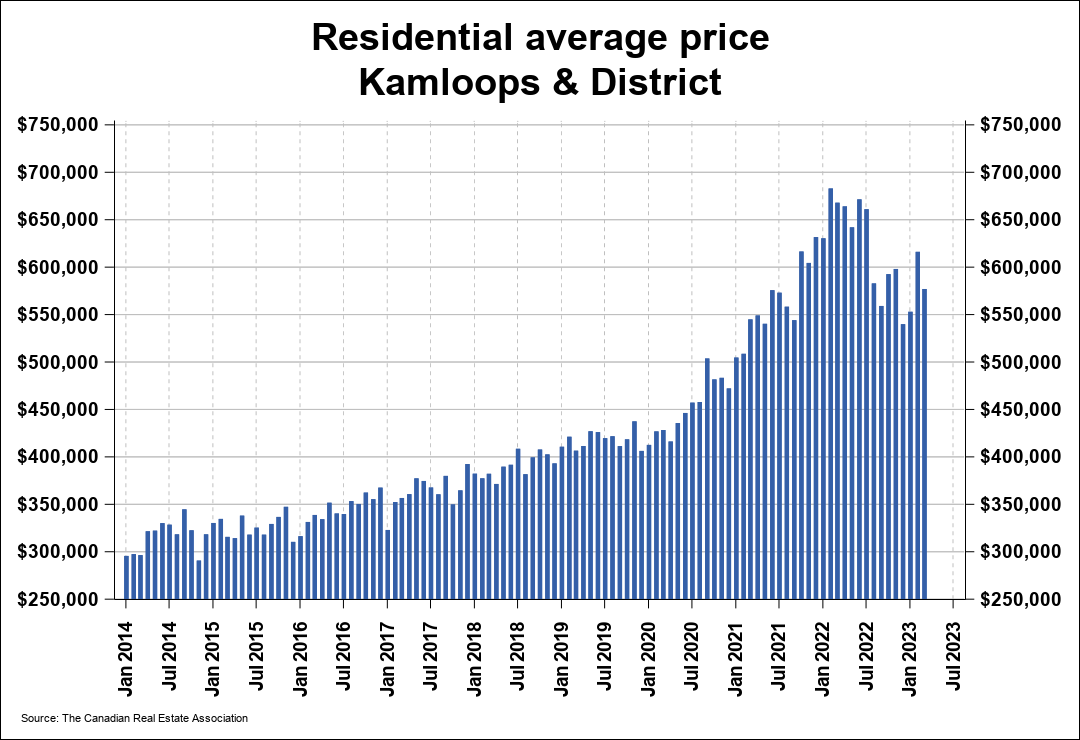

Is Kamloops housing becoming more affordable in 2023? That’s the question on the mind of many homebuyers searching for homes in the BC Interior. It’s clear to anyone following the Canadian real estate market lately that home prices have dropped since 2021. We have returned to a Balanced Market and pre-pandemic home prices. But does that mean that Kamloops housing is actually becoming more affordable for buyers?

The short answer:

On a monthly basis – not yet

In the long term – Kamloops housing is becoming more affordable

Housing Affordability Trade-Off

High interest rates – aimed at lowering inflation – are one of the main drivers for a slow down in home sales across the country and a subsequent decrease in sale prices.

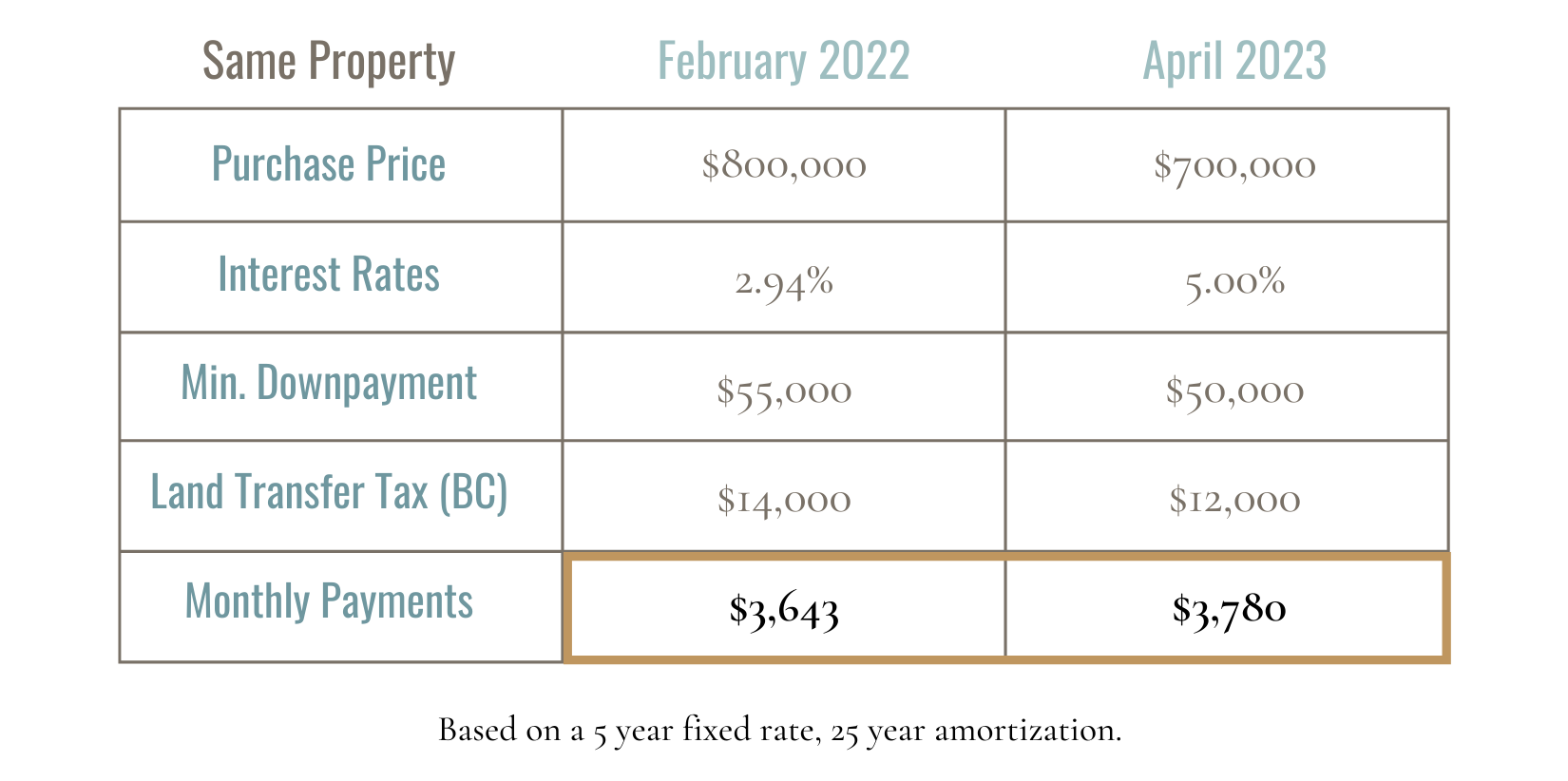

Despite lower housing prices, the increased interest rates since the peak of the market have resulted in higher monthly mortgages. Homeowners may not be seeing a decrease in monthly mortgage costs yet, even if they buy at a lower price. The example above is of a hypothetical property sold at the peak vs. in today’s market. You’ll notice the overall monthly payments are strikingly similar, but there is good news for buyers today and on the horizon. Kamloops housing is becoming more affordable for those who purchase in 2023.

In my opinion, it's always best to purchase property when prices are lower, even if interest rates are higher at the time. The lower purchase price will help save money on your downpayment, land transfer tax and closing costs.

Even if the interest payments are higher at the time of your purchase, they may lower again by the time of your renewal or over time if you choose a variable mortgage. As of April 2023, the Bank of Canada has held it's key interest rate and plans to continue the trend. In the long run, you'll be at an overall advantage to have purchase at a lower price point and having saved significant costs at the time of purchase.

I Want To Sell - But I Missed Out On Top Dollar

Even though Kamloops housing is becoming more affordable for buyers, it doesn't necessarily mean you should put off selling a property. Although house prices are softening, multiple offer situations are still occuring and homebuyers are taking their searches seriously. Sales have slowed down in some price brackets, but in others they've shown stability. Low-moderately priced properties have seen increases sales volume and value. These include:

- mobile home

- condos

- townhouses

- smaller single family homes ($400,000 - $600,000)

It's also important for homeowners who are thinking of selling to look at their own property's history, versus looking at it from the peak down. Very few properties sell in a peak market, so you may be better placed to sell your home in a Balanced Market.

What's key to remember is:

When did you purchase your home and how much did you pay for it?

Was the return on your investment good over that time?

Let's say you purchased a home 5 yrs ago for $400,000 and it is currently worth $700,000. At the peak of the market, a comparable home might have sold for $850,000. Rather than focusing on the potential loss, it's key to remember that your initial investment returned $300,000 over 5 years (11% ROI). Not only is this a very healthy return, but your home also kept up with the market and you are likely in a good position to upsize, downsize or move laterally to a new home.

In the past decade of Kamloops real estate, we have witnessed fluctuations in market prices, but the long term trend of appreciation has continued to rise. So whether you are looking to make the most of this Balanced Market or are still unsure of the market conditions and would like to discuss them, I'm always here to help and available for a call!